Advisors – November 2025

As we enter the final stretch of Medicare’s Annual Enrollment Period, many clients are experiencing plan changes, increased questions, and overall confusion. I appreciate the continued trust and referrals from your office—supporting your clients through Medicare complexities is truly a team effort. If you have clients still unsure about their 2026 options, please feel free to pass this update along or connect them with me directly.

This Month’s Highlights

📰 Medicare Policy Updates

2026 Part B Costs Announced

Medicare has released the updated Part B premiums and deductibles:

- Standard Part B premium: $202.90/month (previously $185 in 2025)

- Part B annual deductible: $283/year (previously $257 in 2025)

This increase is larger than in recent years and reflects rising healthcare costs across the Medicare program.

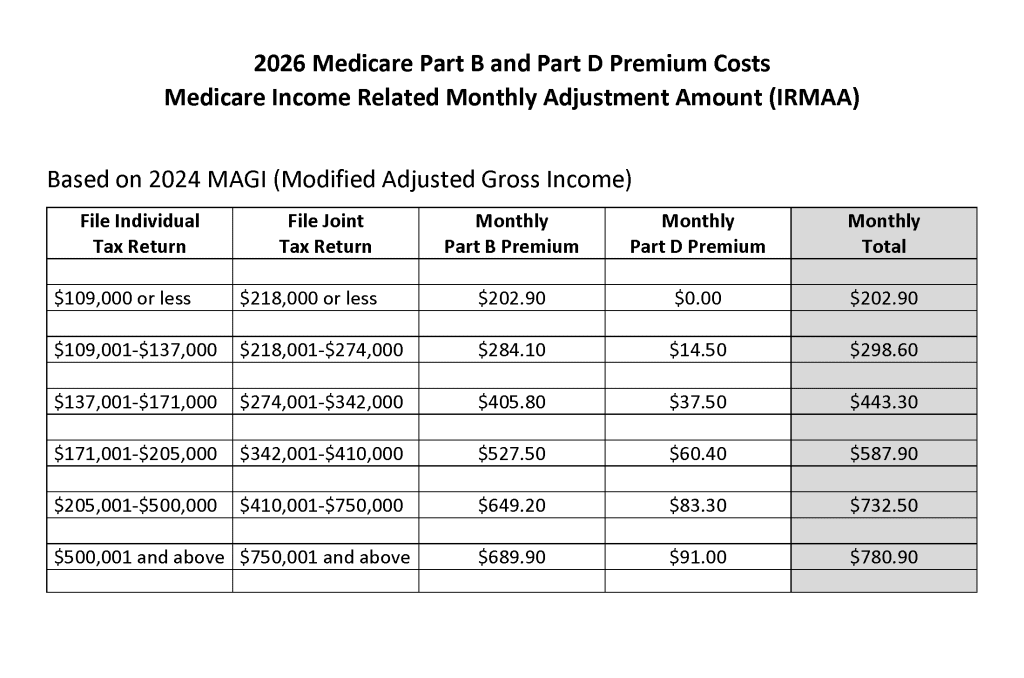

📊 2026 IRMAA Brackets

The updated 2026 IRMAA chart is included in this newsletter for your planning discussions.

- Income thresholds have been adjusted for inflation

- Higher-income clients may see changes in Part B and Part D surcharges

- The new chart can be a helpful tool during year-end and early-year planning meetings

🚨 Major 2026 Plan Disruptions: MA Terminations

Approximately 10% of Medicare Advantage enrollees nationwide are losing their plan for 2026. This affects 2.9 million beneficiaries, up from 2 million last year.

- Several carriers are exiting select markets

- Some plans are being discontinued even if the carrier remains

- Members in terminated plans must choose new coverage by December 31 for a January 1 start

- Client notices vary by carrier and may not clearly outline next steps

- Clients affected by a plan termination receive a Guaranteed Issue (GI) right to enroll in a Medigap plan without medical underwriting

If your clients need support evaluating new options, I’m happy to assist.

📅 Key Dates to Share with Clients

- December 7: Annual Enrollment Period ends

- December 31: Deadline for clients whose 2026 plan is being terminated

- January 1–March 31: Medicare Advantage Open Enrollment (MA-OEP) — one plan change allowed

Partnering Together

Thank you for your ongoing partnership and referrals. Medicare continues to shift rapidly, and I’m here to be a reliable extension of your team—offering clarity, compliance-friendly guidance, and a calm experience for your clients during an overwhelming season.

If you’d like to discuss how I can support your practice, or if you have a client who could benefit from Medicare guidance, please reach out anytime. Referrals are always welcome and appreciated.

Jenell Sobas, FPQP®

Independent Broker and Agency Owner | Key2Medicare Insurance

📧 [email protected] | ☎️ 303-484-1763

🌐 key2medicare.com